Budget

Description of Budget

Monthly Budget is a mobile application designed for finance management, available for the Android platform. This app assists users in tracking their income and expenses, ultimately fostering a healthier financial lifestyle. Individuals can download Monthly Budget to streamline their personal finances, manage family budgets, or even serve as a business financial planner.

The interface of Monthly Budget is both simple and aesthetically pleasing, facilitating a fast and intuitive process for adding new transactions. Users can efficiently log their financial activities, ensuring that all income and expenses are documented accurately. The application also provides a comprehensive income and expense log, enabling users to browse and find each posted transaction easily.

Historical data is another significant aspect of Monthly Budget. Users can access all their past financial records, selecting specific months to view overall monthly statistics and details. This feature allows for a thorough examination of financial patterns and trends over time.

Managing bills becomes effortless with Monthly Budget. Users can set up reminders for upcoming payments, ensuring they never miss a due date. This capability aids in maintaining good financial standing and helps users avoid late fees.

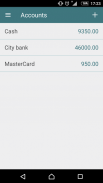

Accounts management is an essential feature of Monthly Budget. With this tool, users can keep track of the money available in various accounts, including bank accounts, credit and debit cards, gift cards, e-money platforms like PayPal, and cash. This feature also allows for transfers between accounts, enhancing financial organization.

Budget tracking is another vital function of the app. Users can set budgets for any expense category and monitor their spending to stay within limits. The app provides a clear overview of transactions related to each budget, allowing users to adjust their spending habits as necessary.

Earnings planning is supported within the app as well. Users can set income targets for specific categories and track their progress towards these goals. This feature fosters financial responsibility and helps users to strategize their earnings effectively.

Data analysis is simplified through visual statistics. Monthly Budget offers graphic charts that present the ratio of expenses, assisting users in reviewing their financial distribution. This analytical tool can highlight areas where users may need to adjust their budgets or spending to achieve their financial objectives.

Database backup and recovery options ensure that users’ financial data remains secure. Users can export transaction records and monthly summaries to an SD card, providing peace of mind in case of device issues.

To protect personal information, Monthly Budget incorporates password protection through a secure 4-PIN number. This feature safeguards sensitive financial data, ensuring that only authorized users can access their information.

The app is versatile, catering to various financial management needs, whether for personal use, family budgeting, or business planning. It simplifies the process of tracking finances, making it accessible for users with different backgrounds.

Monthly Budget promotes money-saving strategies by allowing users to visualize their spending and income patterns. By identifying areas of excess expenditure, users can make informed decisions about where to cut back and how to save more effectively.

Users of Monthly Budget can also benefit from its user-friendly design, which enhances the overall experience of managing finances. The intuitive layout ensures that even those new to financial management can navigate the app with ease.

In essence, Monthly Budget serves as a comprehensive tool for anyone looking to improve their financial health. With its variety of features, including income and expense tracking, bill management, accounts overview, budget setting, earnings planning, and data analysis through charts, users can gain valuable insights into their financial habits.

This app is not only a tool for tracking money but also an educational resource that encourages users to take control of their finances. By utilizing Monthly Budget, individuals can develop better financial habits, leading to long-term financial stability.

For those seeking a reliable application to manage their finances effectively, Monthly Budget provides a robust platform to help achieve financial goals. With its emphasis on user security, data analysis, and budget management, it stands out as a practical solution for modern financial challenges.